GENERAL OVERVIEW

Chartered Accountant (CA) is one of the most prestigious and respected professions of the country, and the dream of lakhs of commerce students in India. Full of challenges, opportunities and responsibility, it is also one of the highly paid professions of the country. Here, in this blog we will introduce you to the roles and responsibilities of a CA, and a general path to pursue this profession.

WHO IS A CHARTERED ACCOUNTANT?

A Chartered accountant is a professional who, broadly, handles the finances of a company or entity and provides financial advice. He/she also carries out different kinds of audits. Each and every company in the country, and the government, requires the expertise of a CA to carry out their day to day financial work. The companies generally seek guidance from various consultancy firms, where CAs are appointed to carry out their work of taxation, budgeting, accounting, business recovery, etc. Similarly, PSUs also recruit CAs for the same purpose. Thus, the scope is available in both private and government sectors. There are immense examples of CAs pursuing everything from entrepreneurship to education, CA Parag Gupta (founder, RKG Institute) being one of them. Thus, the work spectrum of a CA is very wide, and totally depends on the skill set of an individual.

HOW TO BECOME A CHARTERED ACCOUNTANT?

The process of being designated as a CA is carried out by the Institute of Chartered Accountant of India (ICAI), which is a statutory body established by Chartered Accountants act, 1949 of the parliament of India. Once this institute examines your skills through different exams, it certifies you as a CA. The institute carries out examinations at three different levels, namely –

(a) CA Foundation Course

(b) CA Intermediate Course

(c) CA Final Course

The Examinations of all the three stages are conducted every year by ICAI.

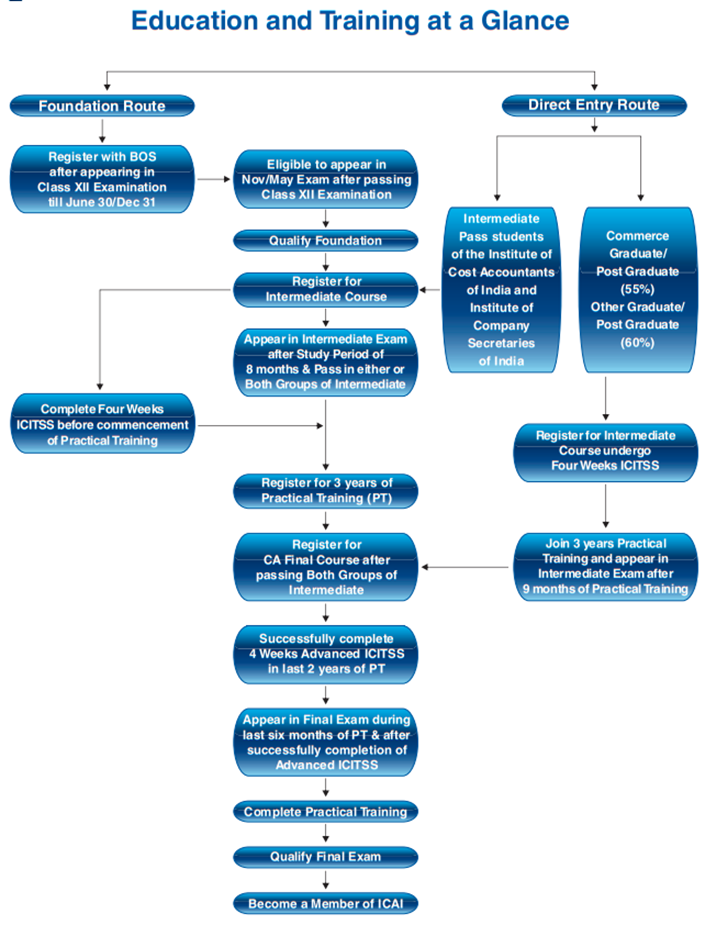

A student has two ways to join the CA course:

- Through foundation course:

- The student can register himself and appear for the foundational course examination right after completing senior secondary (12th) examinations. There is no minimum percentage and stream requirement to appear for foundational course exam. This exam is held twice every year in the months of May/June and November/December. The student can then proceed further in the next stage, detailed information of which will be provided later in this blog.

- Through Direct Enrolment:

- This route allows graduate students to skip the foundation course exam and register directly for the intermediate course. Any commerce graduate/postgraduate student, having scored at least 55% in final year, is eligible to register for CA intermediate course. The eligibility for other graduates/postgraduates is 60%.

STEP BY STEP GUIDE FOR FOUNDATION COURSE ROUTE

Step 1: Enrol for the foundation course right after completing 10th examination, conducted by a recognised board of education.

Step 2: You can appear for the CA foundation examination after completing your 12th from a recognised board, either in the month of May/June or November/December. Register for the examination as per your comfort, on or before 1st January (for may/June exam) or 1st July (for November/December exam).

Step 3: Appear for the foundation course exam after passing 12th examinations.

Step 4: Enrol for intermediate course. Undergo Four Weeks Integrated Course on Information Technology and Soft skills (ICITSS), which includes orientation course and courses on IT. This must be compulsorily completed before proceeding to next step.

Step 5: Appear in intermediate examination. Intermediate exam consists of two groups. You may proceed further after clearing one, or both the groups of intermediate exam.

Step 6: Join articled training under a CA for three years after clearing one or both groups of intermediate examination.

Step 7: Clear the second group of intermediate exam during articleship (if not cleared before).

Step 8: Register for final course. Undergo Four Weeks Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.

Step 9: Appear for the final examination after completing the articleship, or while serving in the last 6 months of articleship.

Step 10: Once you complete your articleship of 3 years and pass the final examination, you are designated as a Chartered Accountant by ICAI.

STEP BY STEP GUIDE FOR DIRECT ENROLMENT ROUTE

Step 1: Complete your graduation/postgraduation with a minimum of 55% in commerce or 60% in other courses.

Step 2: Enrol for the intermediate course. Undergo Four Weeks Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course.

Step 3: Register for articled training for 3 years under a CA.

Step 4: You can appear in the intermediate exam after the completion of first 9 months of articled training.

Step 5: Appear and pass in both the groups of intermediate examination.

Step 6: Register for CA Final course. Undergo Four Weeks Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.

Step 7: Appear in the final exam after completing practical training, or while serving in the last 6 months of the training.

Step 8: Once you complete your practical training and pass the final exams, you are designated as a Chartered Accountant by ICAI.

The ICAI has described this procedure through the following flowchart:

STRUCTURE OF THE EXAMINATION

FOUNDATION COURSE

- Eligibility criteria : Passed in senior secondary examination through a recognised board, in any stream.

- Total fees: approx ₹11,000 (aggregate)

- Total papers: 4

- Structure of questions: Both objective and subjective, 2 papers each.

- Duration of exam: 3+2 hours

- Mode of exam: Offline

- Minimum cutoff to qualify: 40% in each paper or 50% aggregate.

PAPER PATTERN

| Paper | Marks | Type |

| 1: Principles and Practice of Accounting | 100 | Subjective |

| 2: Business laws and business correspondence and reporting. | Section A – Business laws = 60 Section B – Business correspondence and reporting = 40 | Subjective |

| 3: Business Mathematics, Logical Reasoning, And Statistics | Business mathematics = 40 Logical reasoning = 20 Statistics = 40 | Objective. Negative marking of 0.25 |

| 4: Business economics and business & commercial Knowledge | Business economics = 60 Business and commercial knowledge = 40 | Objective. Negative marking of 0.25 |

INTERMEDIATE COURSE

- Eligibility criteria: Qualified foundation course OR completed graduation/postgraduation OR passed Intermediate level examination of Institute of Company Secretaries of India or Institute of Cost Accountants of India.

- Total fees: ₹18,000 for both groups and ₹13,000 for one group.

- Total papers: 8 (divided in 2 groups)

- Structure of questions: both subjective and objective

- Mode of exam: Offline

- Minimum cutoff to qualify: 40% in each paper or 50% aggregate.

PAPER PATTERN

| Paper | Marks |

| Group 1 | |

| 1: Accounting | 100 |

| 2: corporate laws and other laws | Corporate laws = 60 Other laws= 40 |

| 3: cost and management accounting | 100 |

| 4: Taxation | Income tax laws= 60 Indirect taxes= 40 |

| Group 2 | |

| 5: Advanced Accounting | 100 |

| 6: Auditing and Assurance | 100 |

| 7: Enterprise Information Systems & Strategic Management | Enterprise information system = 50 Strategic management = 50 |

| 8: Financial Management and Economics for finance | Finance management = 60 Economics for finance = 40 |

FINAL COURSE

- Eligibility criteria: Qualified intermediate course and completed atleast 2.5 years of practical training.

- Registration fees: ₹22,000 for both groups.

- Total papers: 8 (divided in 2 groups)

- Duration of exam: 3 hours for each paper

- Mode of exam: Offline

- Minimum cutoff to qualify: 40% in each paper or 50% aggregate.

| Paper | Marks |

| Group 1 | |

| 1: Financial Reporting | 100 |

| 2: Strategic Financial Management | 100 |

| 3: Advanced auditing and professional ethics | 100 |

| 4: Corporate and economic laws | Corporate laws = 70 Economic laws = 30 |

| Group 2 | |

| 5: Strategic Cost Management and Performance Evaluation | 100 |

| 6: Elective paper 6A: risk management | 100 Only one to be chosen |

| 6B: Financial services and capital market | |

| 6C: International taxation | |

| 6D: Economic laws | |

| 6E: Global Financial Reporting Standards | |

| 6F: Multidisciplinary Case Study | |

| 7: Direct Tax Laws and International Taxation | Direct tax laws = 70 International taxation = 30 |

| 8: Indirect Tax Laws | Goods and services tax = 75 Customs and FTP = 25 |

The detailed syllabus and further information will be shared in the next blog.

Stay tuned!